GoDerivatives

Decentralized platform for trading Contracts for Difference (CFD) derivatives

Project Description

GoDerivatives Protocol is a fully decentralized platform for trading Contracts for Difference (CFD) derivatives.

Main ideaCFDs are financial instruments that allow traders to speculate on the price movement of an underlying asset, such as stocks, commodities, or cryptocurrencies, without actually owning the asset. In a decentralized GoDerivatives platform, the process of trading and settling contracts is done via a distributed network, typically built on blockchain technology.

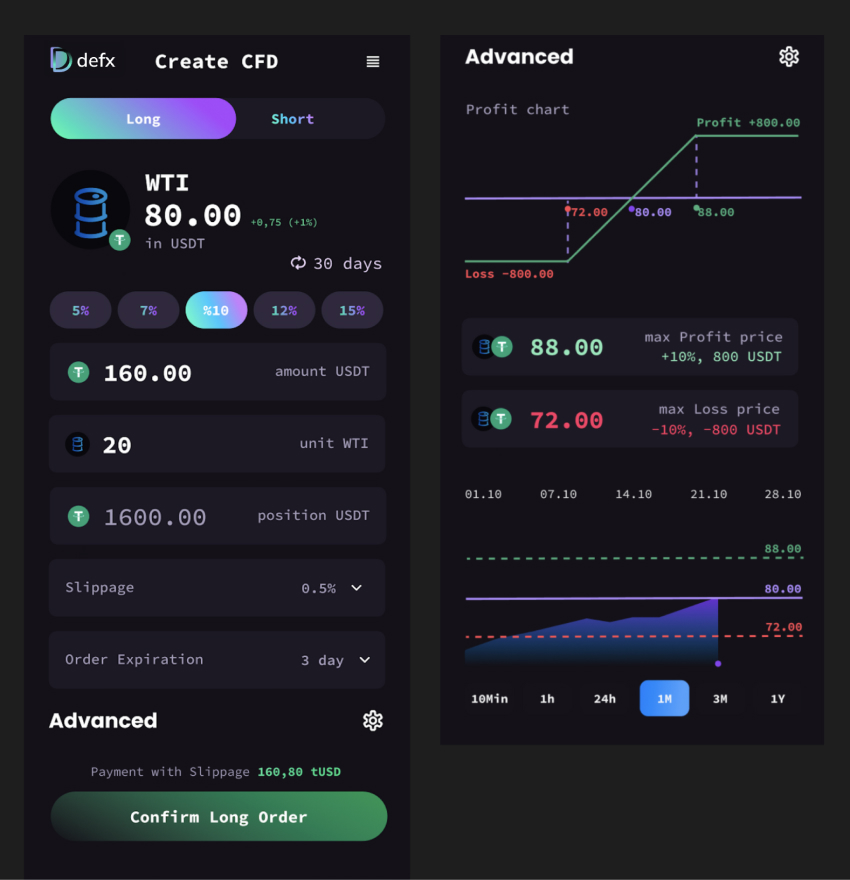

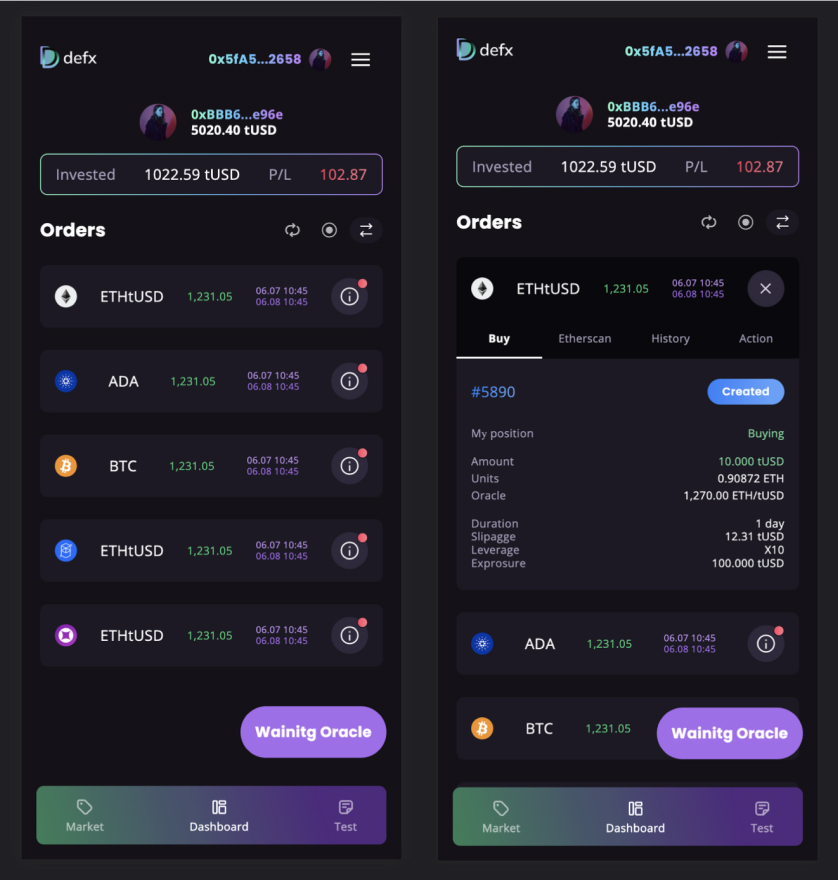

Main functionalTwo traders looking to place bets on an underlying asset reaching a specific level meet on the platform. One of the traders (Maker) initiates a new order with specific conditions and parameters related to the underlying asset. The second trader (Taker) can confirm this order. If the order is confirmed, the trade is considered to be started.

To initiate the order, the Maker must deposit a collateral into the smart contract based on the percentage chosen in the order parameters (e.g., 10%). The Taker is also required to deposit the same amount of collateral into the smart contract. In this way, the risk of non-performance of obligations by both parties will be covered from both sides at the level chosen when creating the order.

After the Duration period of the deal ends, the GoDerivatives protocol checks the price of the underlying asset against the oracle data and automatically calculates the winning and losing shares based on the CFD pattern. From this point on, both the Maker and the Taker can initiate the return of the collaterals, either deducting the loss or adding the profit they are entitled to. This system assumes that the maximum profit or loss is limited to the collaterals deposited by both parties and is, in essence, 100% covered, as the collaterals are frozen in the smart contract until the final calculations of gains and losses are made.

Keepers systemIn the GoDerivatives platform, a Keeper can create new markets for new underlying assets to be used by Makers and Takers. To do this, the Keeper freezes collateral to provide liquidity for the new market and sets up an Automated Market Maker (AMM) strategy.

SummaryGoDerivatives is a decentralized platform for trading Contracts for Difference (CFD) derivatives on various underlying assets. It allows users to create and confirm orders through a trustless, secure, and transparent system. The platform utilizes Automated Market Maker (AMM) strategies to facilitate trading and manage liquidity. This dynamic ecosystem offers a wide range of trading opportunities and encourages active user participation in the platform's growth and development.

How it Works

Trader Maker- The Maker and Taker find each other on the GoDerivatives platform, looking to trade on the same underlying asset.

- The Maker creates a new order specifying the conditions, such as the price level, the percentage of collateral, and the duration of the contract.

- The Maker deposits the required collateral into the platform's smart contract. The collateral could be in the form of a stablecoin, cryptocurrency, or tokenized asset.

- The Taker reviews the order and, if they agree to the conditions, confirms the order by depositing their share of the collateral into the smart contract.

- Once both parties have deposited their collateral, the smart contract locks the funds and monitors the underlying asset's price throughout the contract's duration.

- After the Duration period ends, the GoDerivatives protocol checks the underlying asset's price against the Oracle data and calculates the profits and losses based on the CFD pattern.

- Both the Maker and the Taker can then initiate the return of their collaterals, either deducting the loss or adding the profit they are entitled to.

- Creates markets for new underlying assets.

- Sets up an Automated Market Maker (AMM) strategy and deposits collateral into the smart contract for initial liquidity.

- Earns rewards from the activities within the created market.

How it's Made

GoDerivatives was started during Hackathon KLAYMAKERS 2022 and achieved KlayMakers Prize.

Technologies we used in GoDerivatives:- We use Klaytn blockchain

- Smart contracts are written in Solidity 0.8.9

- Smart contracts are deployed to Klaytn Baobab Testnet

- Front-end is written in Next Js

- Front-end is deployed on Vercel

- We used theGraph (mock)

- We used the Rainbow kit for connect wallets

-

Traders

- Make Deal Order

- Take Deal Order

- Selling ownership of Deal to other Traders (by NFT)

-

Keepers

- Creation Markets

- Creation AMM (Auto Market Maker strategies)

- Receive profit

-

Core Protocol

- Read Oracles

- Calculate profit and loss every Deal

About

Main functional

CFD Derivatives

Type of decentralization

Fully Decentralized

Version

Version Hackathon

Created at

Hackathon KLAYMAKERS 2022

Prize

KlayMakers Prize