D4X.io

"Decentralization for X" - decentralized protocol of making trade positions with leverage

Project Description

D4X.io - a decentralized protocol for creating and managing leveraged trading positions in the cryptocurrency market. It aims to bring the benefits of blockchain technology, such as transparency, security, and accessibility, to the world of leverage trading.

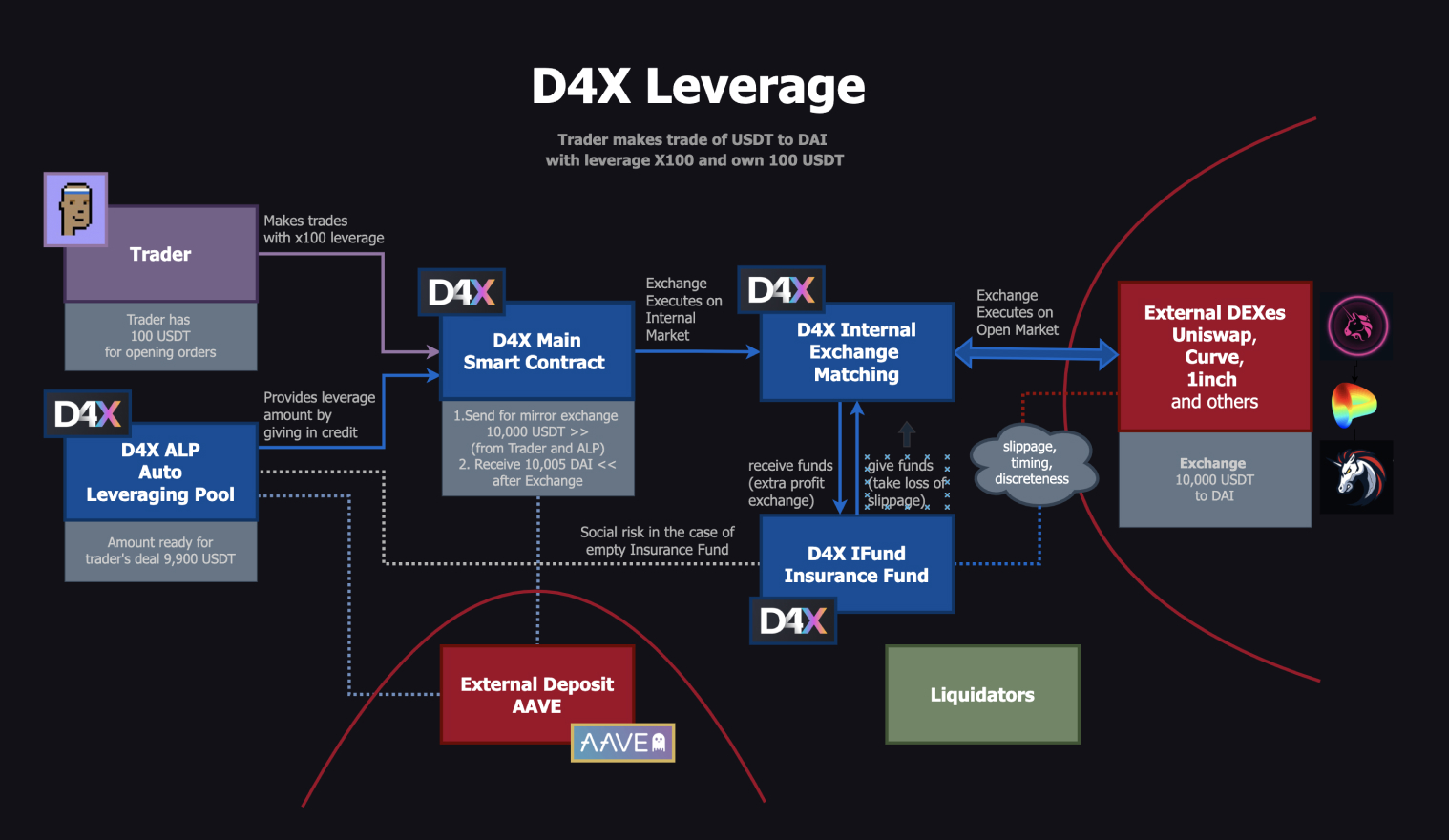

Main ideaD4X is designed as a protocol that allows traders to establish long and short positions in the cryptocurrency market by automatically borrowing funds from investors in the ALP Pool. Traders could use leverage, which means they can control a larger position with a smaller amount of capital. The trader receives the entire profit from opening and closing positions, after deducting fees as a percentage for utilizing borrowed funds from investors in the APL Pool and the protocol fees.

Fairness of tradesFairness of trades is preserved by using cryptocurrency exchange rates and performing swap operations directly on particular decentralized DEXes. This method removes the need for middlemen and minimizes the possibility of price manipulation or preferential treatment, guaranteeing that trades take place in a transparent and trustless environment.

Security of Investors fundsAll open positions of traders are fully supported by swap operations on integrated DEXes and are 100% covered by corresponding amounts of cryptocurrencies resulting from these swaps. To protect investors' funds and to prevent traders from facing substantial losses, the protocol integrates an automated decentralized Liquidation mechanism for opened positions. In addition to this, the Insurance Fund is established, which safeguards investors of ALP Pools and provides the first level of coverage for hypothetical losses resulting from unfavorable swap rates, slippage and delays during the liquidation process.

SummaryBy offering a decentralized solution for leverage trading, D4X aims to provide a more transparent, secure, and accessible way to participate in the global cryptocurrency market. However, it's crucial for users to understand the risks associated with leveraged trading and to consider their own risk tolerance before engaging in such activities.

How it Works

Investor- Invest funds in the ALP pool to earn profits from lending leverage to traders for fee.

- Receive LP tokens that can be redeemed or sold on the open market.

- Earn additional profits from the AAVE protocol for idle funds (not in positions).

- Buy and sell leveraged positions of coins using funds borrowed from the ALP pool.

- Reap profits in favorable market conditions and incur losses in unfavorable ones.

- Trader's positions may be automatically liquidated to protect the credited funds and prevent larger losses for the trader.

- Calculate the maximum leverage for positions using the Margin Engine, granting traders access to borrowed funds.

- Oversee the liquidation process in a fully decentralized manner.

- Protects investors against potential losses resulting from unexpected events during the liquidation swap process.

- Accumulates rewards for the DAO Community, contributing to the overall sustainability and growth of the platform.

- Govern the protocol through decentralized decision-making, with participants voting on proposals and updates related to the platform.

How it's Made

D4X.oi was started during Hackathon ETHONLINE 2022 and achieved 🥉 deBridge —

Best Use Prize.

During Q4'22 and Q1'23 D4X Protocol was developed from PreAlpha Hackathon

Version to Alpha Version 1.2. according to Roadmap

- We use Ethereum-like blockchains

- Smart contracts are written in Solidity 0.8.9

-

Smart contracts are deployed to

- Optimism Goerly Testnet

- Polygon Mumbai Testnet

- Front-end is written in Next Js

- Front-end is deployed on Vercel

- We used theGraph

- We used the Rainbow kit for connect wallets

- Automation by Chainlink Keeper

-

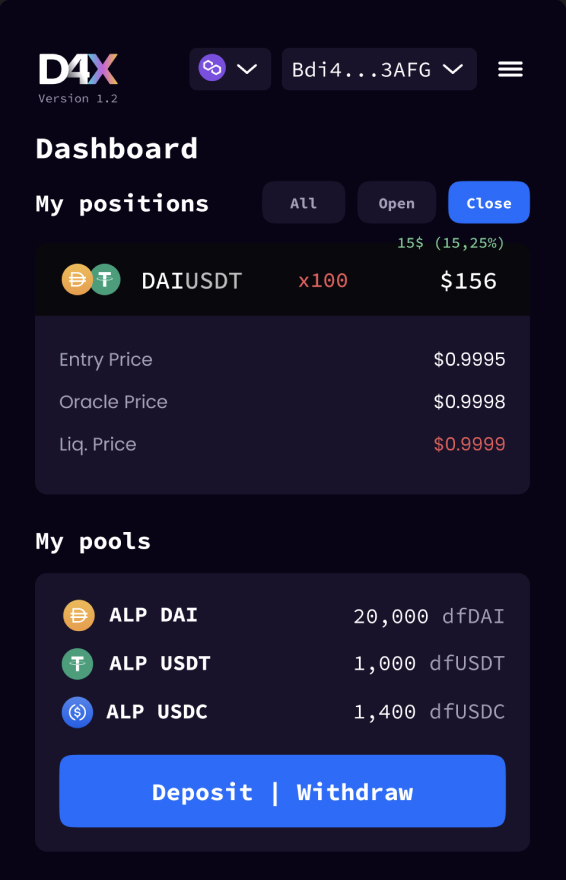

Trader's Positions

- Open Position

- Close Position

- Auto Liquidation by Keeper

-

ALP Pool

- Deposit

- Redeem/Withdraw

- LP Tokens System

- Auto Profit Calculation

-

Insurance Fund

- Loss protection System

- Credit System

- Auto swapping funds for Keeper

-

Additional profit for Investors

- Send free funds of ALP and Position to AAVE protocol

About

Main functional

Trade Positions with Leverage

Type of decentralization

Fully Decentralized

Version

Version V1.2 Test Alpha

Created at

Hackathon ETHONLINE 2022

Prize

deBridge Prize